Market Watch Q2

Unveiling The Market's Q2 Triumphs of 2023!

Positive Annual Price Growth Returns for First Time in 10 Months

Greater Toronto Area resale activity and average selling prices recorded positive annual growth in June while experiencing declines from May due to typical seasonal forces as well as increased caution on the part of buyers as the Bank of Canada resumed interest rate increases

A still highly competitive market saw the average home sell for 104% of list price in June, edging down from 105% in May

For the first time in 10 months, average selling prices recorded positive year-over-year growth, rising 3.2% from a year ago to $1.182 million. Prices were up by a total of 8.5% over the past two years and by 27% over the past three years. Month-over-month prices dipped by 1.2%, which is generally consistent with typical seasonal norms.

Inventory Updates

Despite a 4% increase over May, new listings in June were down 3% annually and were 5% below their 10-year average.

The bump in new listings from May to June reduced the ratio of sales-to-new listings to a five-month low of 47%, which was below the 10-year average of 56%

Inventory rose between May and June across all housing types, remaining highest for condo apartments at 2.3 months and lowest for semis/rows/towns at 1.5 months. Inventory levels for condo apartments and semis/rows/towns increased slightly above their 10-year averages of 1.4 and 2.2 months, respectively, while detached inventory at 1.9 months was slightly below its 10-year average of 2.1 months

Condos Continued to Lead Sales Growth

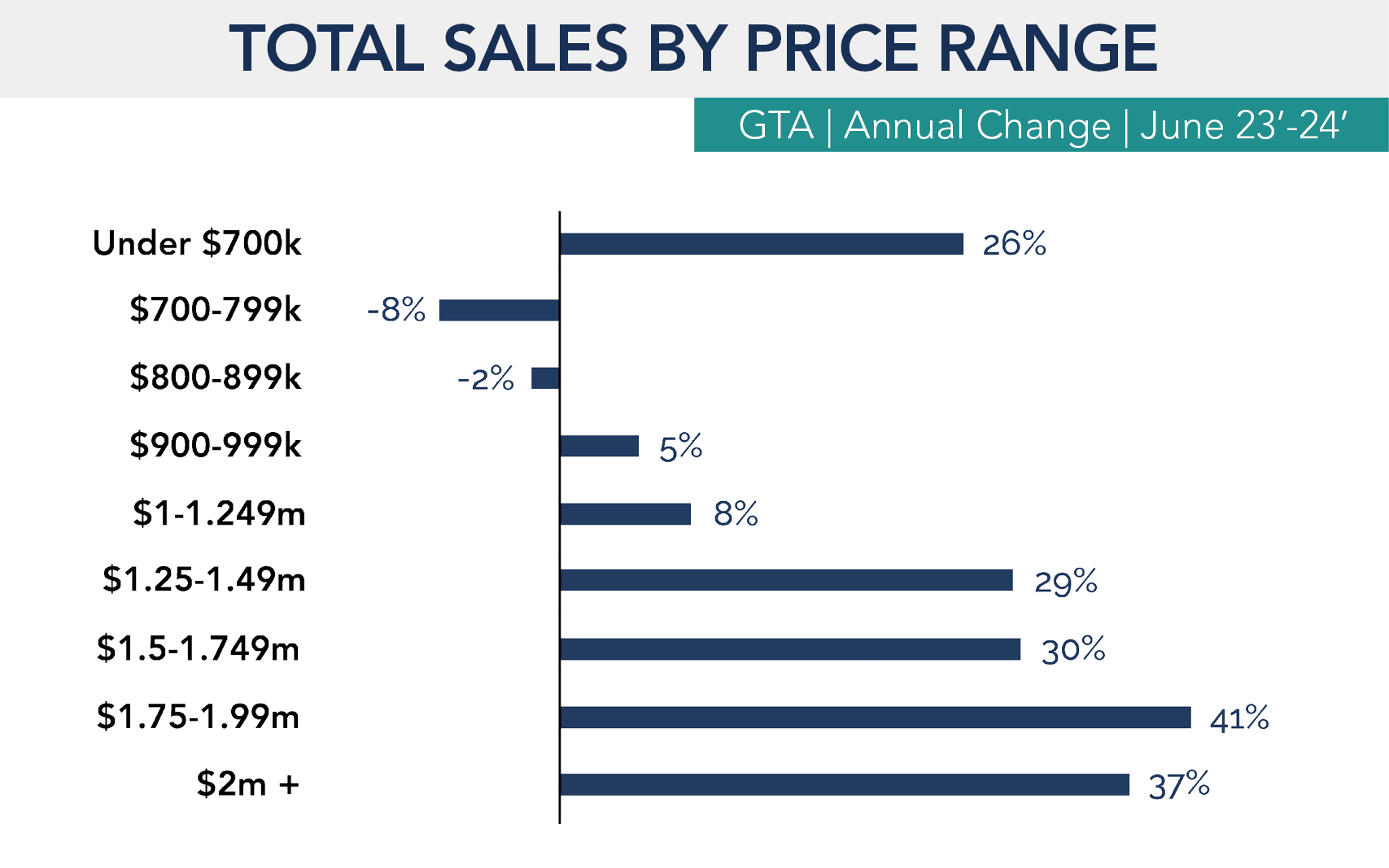

On an annual basis, sales increased across all price segments other than the $700-799K and $800-899K ranges. Year-over-year sales increases were strongest in the higher end of the market, led by a 41% increase in activity for $1.75-1.99 million homes and a 37% increase in homes priced $2 million-plus.

Sales grew 16% year-over-year in June, which was a larger-than-normal decline typically seen at this time of year as the market transitions towards the slower summer months. Sales last month were 20% below the 10-year average for June periods (9,310 sales).

All housing types recorded sales activity in June that was higher than a year ago but lower than their 10-year average. The strongest annual growth of 27% was experienced by condo apartment sales, which were within 8% of their 10-year average. Detached houses and semi/row/towns had relatively lower annual sales growth of 13% and 11%, respectively, with activity in June substantially below (-24% and -22%) their 10-year averages

Market Health based on Supply Levels

Seller’s Market = 4 months of inventory or less

Balanced Market = 4 - 6 months of inventory

Buyer’s Market = 6 months of inventory or more

The overall amount of supply in the market remained low at month-end, with active listings down 12% year-over-year to 14,107 units — 15% below the 10-year average. While the level of inventory moved up from 1.3 months in May (a 14-month low) to 1.9 months in June, it was directly in line with the 10-year average.

The upward momentum that the market experienced between February and May subsided during June as sales moderated heading into the slower summer period and the Bank of Canada surprised with a further interest rate increase of 25 basis points.

While the decline in housing sales between May and June was more than typically seen at this time of year and new listings showed improvement, prices largely held steady during the month as overall supply levels remained low and market conditions stayed balanced.

What’s Next?

Any further interest rate increases by the Bank of Canada are expected to be marginal at this point. While the economy is running a bit stronger than anticipated by the Bank of Canada, including higher-than-expected jobs growth, inflation is clearly slowing, decelerating from 4.4% in April to a two-year low of 3.4% in May.

As interest rates have risen 325 basis points over the past year (to June) and a total of 450 basis points since the low during COVID, rates are at a restrictive level for the economy, which should cause inflation to fall into the Bank of Canada target range of under 3%. This should lead to decreases in interest rates, first for fixed-rate mortgages in the coming months and then variable rate mortgages likely sometime in 2024.

The fact that GTA housing prices returned to positive year-over-year growth in June should provide a signal to the market that the correction is likely over, adding confidence to both buyers and sellers.