Market Watch Q4

let’s take a look at what happened this past year.

Sales Fall to 14-Year Low but Prices Still Manage 9% Growth in 2022

For 2022 as a whole, sales totaled 75,131 transactions, down 38% from the record high in 2021 (121,611) and representing a 14-year low. The 20-year average for annual sales was 89,376. Despite the decline in sales in 2022, supply stayed below historic norms as homeowners held back on listings their properties for sale and new housing completions remained low.

While sales activity has remained well below normal over the past nine months as market uncertainty grew and affordability worsened, the vast majority of the price correction so far happened during the initial few months of the slowdown.

This means that only a very small portion of buyers over the last two years have seen the value of their home purchase decline. Almost all current homeowners saw growth in the value of their homes when looking at 2022 as whole, with prices up substantially since the start of the pandemic.

2022 was an adjustment year for the GTA housing market, which occurred following overheated market conditions in 2021 and aggressive interest rate increases by the Bank of Canada to combat quickly rising inflation.

Prices Relatively Stable in December for Detached Homes and Condos in the Core

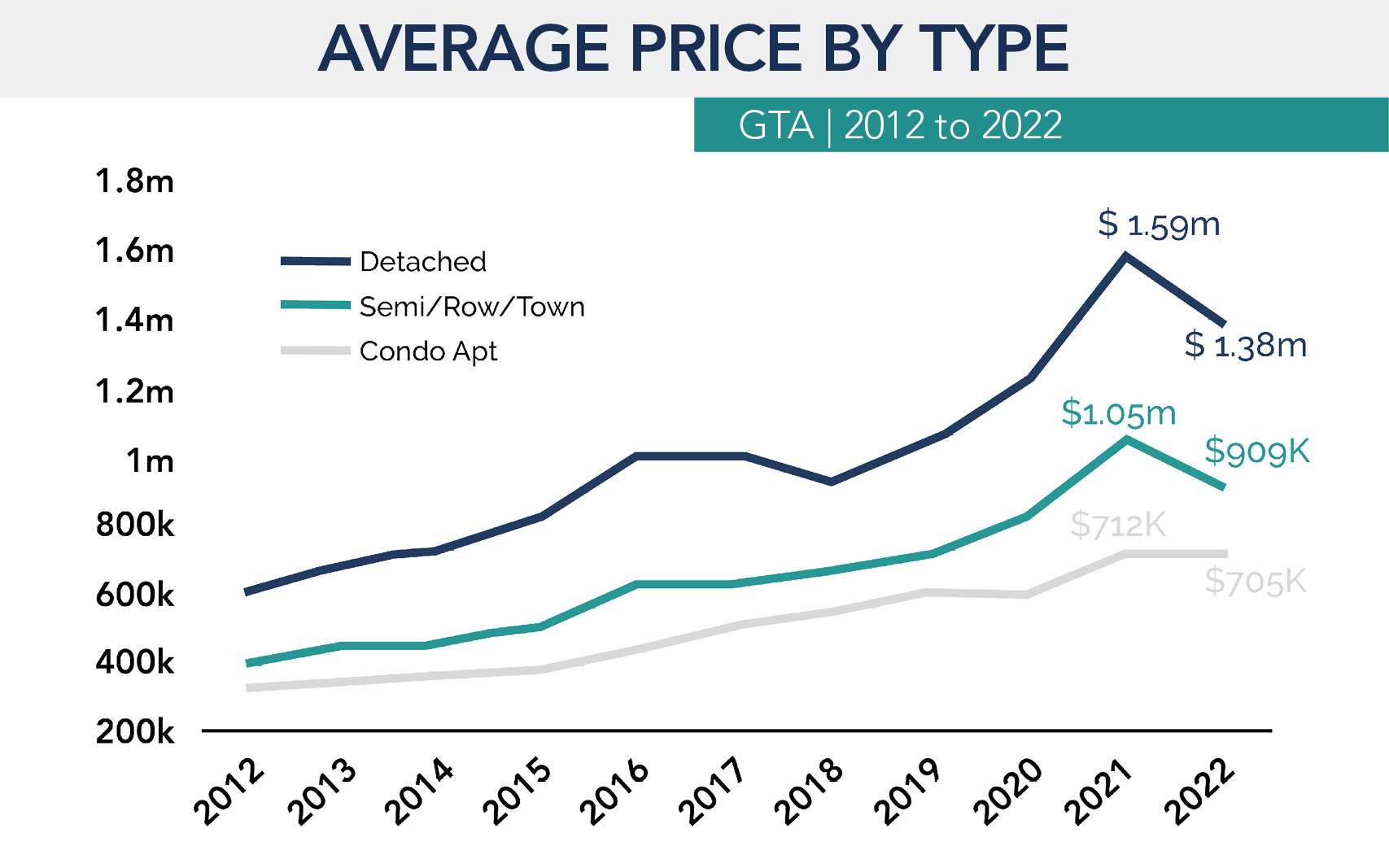

Average sale prices were $1.05 million in December, compared to the absolute peak in February 2022 ($1.33 million), average prices have decreased by 21.2%

Due to the strong increase in prices in late 2021/early 2022, the overall average price increase for 2022 was 8.6%, which followed 17.8% growth in 2021 and 13.5% growth in 2020. In 2008, the last time sales were this low, average price growth was 0.7%. The 20-year average for GTA resale price growth was 7.7%.

The top 10 markets in the GTA for average price growth in 2022 were concentrated in the east and west ends of the GTA. Annual price growth was led by the Durham Region communities of Brock and Scugog, posting increases of 15.6% and 12.9%, respectively. Western GTA markets of Brampton and Vaughan ranked third and fourth with average annual growth of 12.4% and 12.3%.

Let’s take a look at Detached, Semis & Condo Markets per area

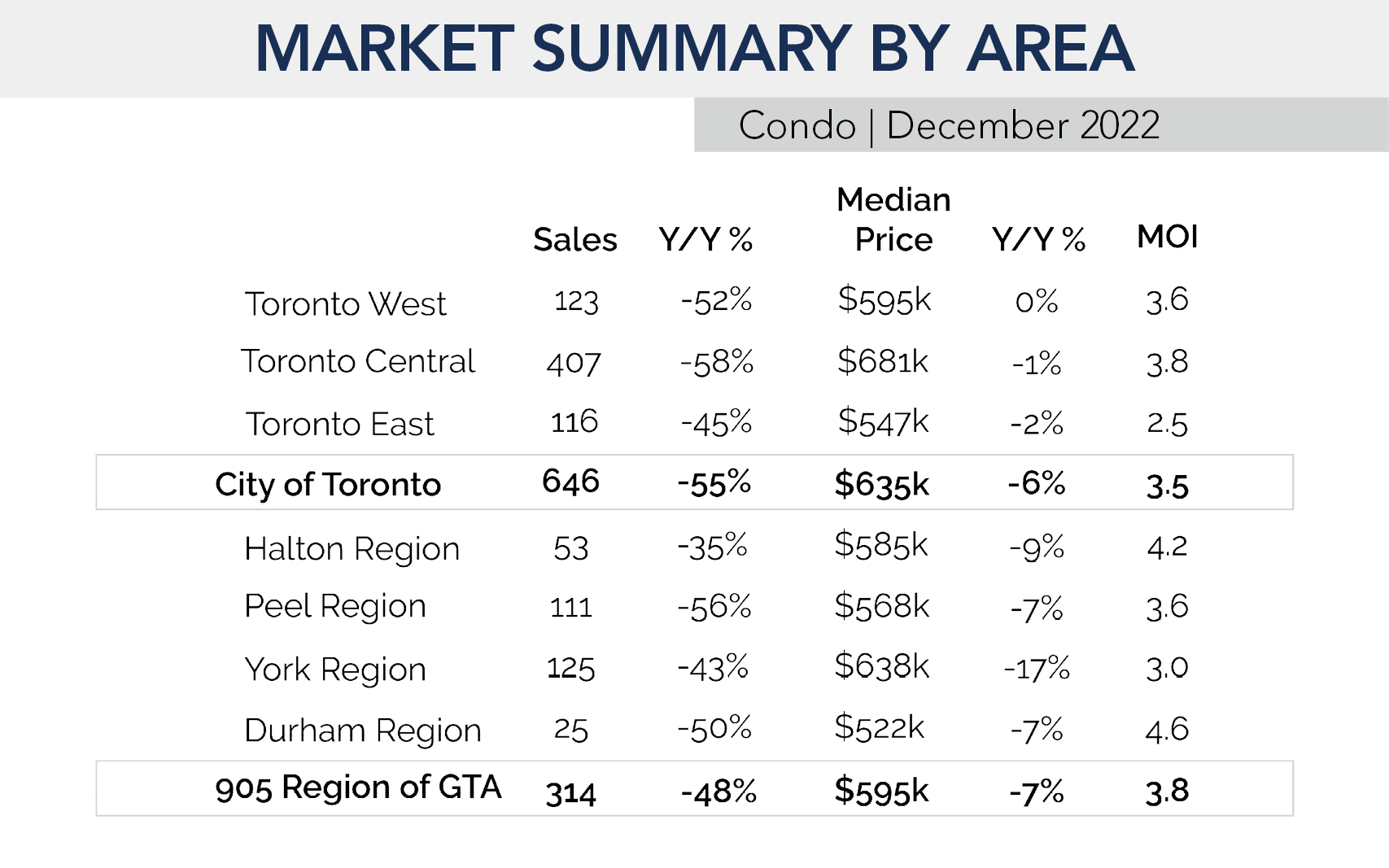

Isolating the December results by housing type and region, annual sales declines were fairly equal across the market, while the largest declines in median prices were found for detached homes in Toronto East and Peel Region, and semis/rows/towns in Halton Region – all posting 19% annual price decreases.

Detached homes saw their share of total sales decline to a four-year low of 45%, with slower overall annual average price growth of 7%. However, this followed detached price growth averaging 25% in 2021.

At the same time, however, supply levels for detached homes were lowest in Toronto East at 1.7 months, suggesting support for prices going forward. Relatively mild price decreases in December were found amongst Central Toronto detached homes and City of Toronto condos, both recording 2% annual price declines

The Condo Market Outperformed in 2022

The condo market outperformed in 2022, with its share of total sales reaching a four-year high of 29% and prices rising by an average of 11%.

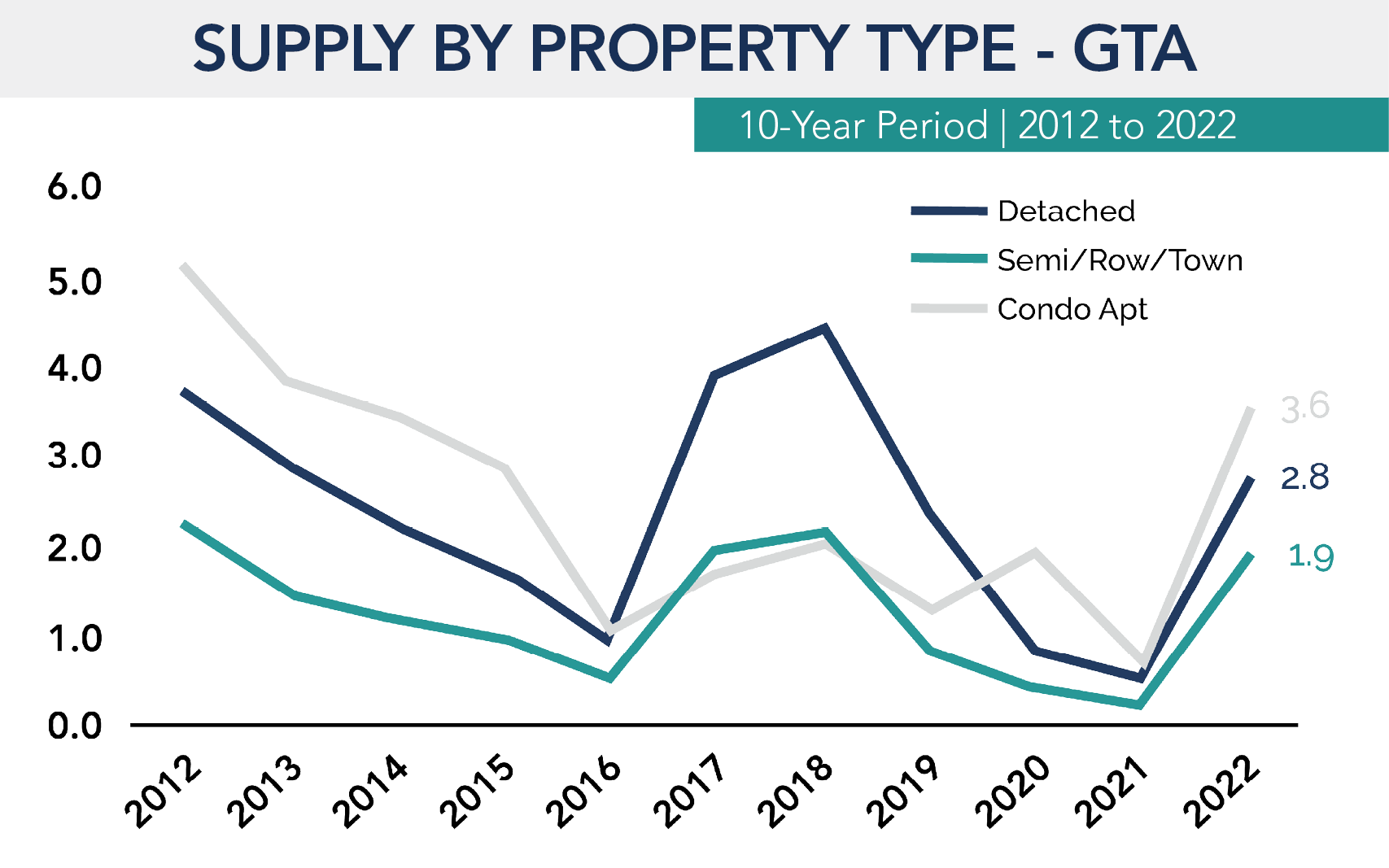

At year-end, inventory levels were highest for condo apartments at 3.6 months of supply, which was still considered a balanced level. Lower supply levels of 2.8 months and 1.9 months were found in the detached and semi/row/town categories, respectively, which will help support low-rise prices going forward.

Over the last 10 years, average annual price growth has been strongest for semis/rows/towns at 10.1% per year, compared to an average of 9.8% annual growth for detached homes and 8.6% for condos.

What occurred with supply in 2022

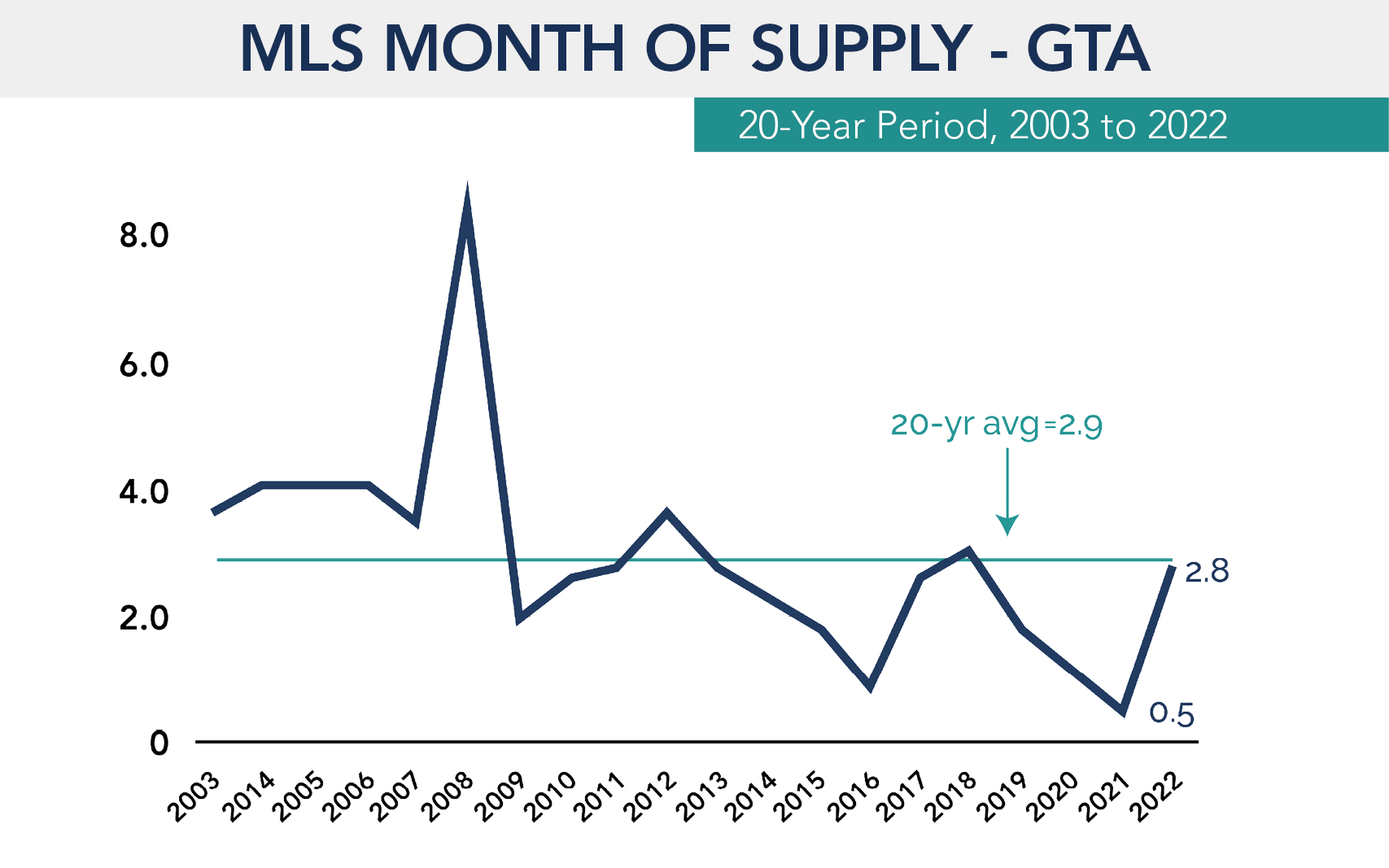

Active listings at year-end totaled 8,964 homes, 27% below the 20-year average (11,952). For context, the last time sales were this low back in 2008, active listings totaled 21,742.

The 2.8 months of supply on the market at year-end was directly in line with the 20-year average (2.9 months), which has helped to provide some support for prices.

At year-end, inventory levels were highest for condo apartments at 3.6 months of supply, which was still considered a balanced level. Lower supply levels of 2.8 months and 1.9 months were found in the detached and semi/row/town categories, respectively, which will help support low-rise prices going forward.

Over the past six months since July, prices have largely trended sideways despite most of the interest rate increases in 2022 having occurred during this time. This speaks to the low structural supply levels in the GTA, occurring as housing construction failed to keep pace with population growth in recent years and strong credit quality kept mortgage delinquencies at record low levels.

What to expect next year?

With markets pricing in an economic slowdown and downward pressure on inflation, Government of Canada bond yields have receded and fixed-term mortgage rates have slid below 5% at some lenders. While the stress test rate at close to 7% continues to act as a barrier for many buyers, declining interest rates have helped improve affordability recently as prices have declined and incomes have grown amid a strong labour market.

Buyer confidence is expected to improve in 2023 as rates stabilize, which should begin to unleash some pent-up demand and lift sales activity off their recent lows. While supply is also likely to increase this year as homeowners who put off listing last year enter the market, an increased number of homeowners face financial difficulties due to the increase in rates, and condo completions rise to record highs, prices are expected to bottom early this year before experiencing a modest recovery in the second half of 2023.

Note that it could take an extended period of time before prices return to their peak February 2022 level.

In 2023, the market is expected to continue adjusting from overheated conditions during the ultra-low interest rate environment of the pandemic. In that sense, sales levels are likely to remain below average and price growth will be minimal.

The long-term outlook for the market remains positive, as demand will be boosted by record levels of immigration (most newcomers will initially rent and enter the ownership with a 2-5-year lag) and supply will begin to decline as new home sales have dropped, supporting growth in prices.